Understanding Solar Tax Benefits: A Comprehensive Guide to the 30% Tax Credit in 2024

What is the solar tax credit?

The Residential Clean Energy Credit, often called the federal solar tax credit, is an incentive you can earn when installing solar panels or other clean energy equipment on your property. The tax credit equals 30% of installation costs and can reduce what you owe in federal income taxes by thousands of dollars.

Begin in January 2023, households can receive an uncapped 30% tax credit for a battery storage installation, even if it's not paired with a solar system. Here we listed some frequently asked questions and answers to them.

How does the 2024 federal solar tax credit work?

The solar tax credit is a dollar-for-dollar reduction of what you owe in federal income taxes. So, if you owed $15,000 in income taxes and earned a $6,000 solar tax credit, your tax liability would drop to $9,000.

Will the tax credit increase my tax refund?

You may see a higher tax refund when you claim the federal solar tax credit, depending on what you owe and what you withheld for the year.

The tax credit reduces what you owe for the year. So, if you already withheld enough money from your paychecks to cover what you owe, you would earn whatever refund you were already going to get, plus the tax credit value.

Example to illustrate how the solar tax credit could impact a refund:

“Let’s say you spent $20,000 on solar; the tax credit is $6,000. If you owed $20,000 in taxes but withheld $25,000 throughout the year on your paychecks, your refund would be $11,000: $6,000 from the federal tax credit and $5,000 from the income taxes.”

However, you won’t always get the tax credit back in your refund check. If you didn’t withhold enough money throughout the year to cover your liability, the tax credit will simply lower what you owe.

What if my tax liability is lower than my tax credit value?

The Residential Clean Energy Credit is nonrefundable, meaning it can’t reduce your full tax liability to less than $0.

If what you owe in taxes is lower than the value of your solar tax credit, your tax liability will be $0. But that doesn’t mean you lose the rest of the tax credit value! The remainder of your credit can roll over and reduce what you owe the following year.

For example, if your solar tax credit was worth $6,000, but you only had $5,000 in tax liability, you would owe $0 in federal income taxes. The remaining $1,000 would roll over and reduce what you owe the following year.

This might seem like a lot to keep track of, but don’t worry. Once the tax credit is applied to your taxes, there will be a record of how much is available to carry over. Most tax software will automatically roll the amount over for you the next time you file. Your return will also include a schedule showing the amount used and what will be carried over to show your tax preparer.

How much is the federal solar tax credit worth?

The solar tax credit equals 30% of solar installation costs in 2024. The average solar installation costs around $20,000, and the typical tax credit value is about $6,000.

The total value of the solar tax credit will depend on the solar installation cost. The following table outlines estimated tax credit values for solar installations of various sizes based on the average cost of solar:

| System size | Average tax credit value |

|---|---|

| 4 kW | $3,600 |

| 6 kW | $5,400 |

|

8 kW |

$7,200 |

| 10 kW | $9,000 |

| 12 kW | $10,800 |

| 14 kW |

$12,600 |

Does the solar tax credit expire?

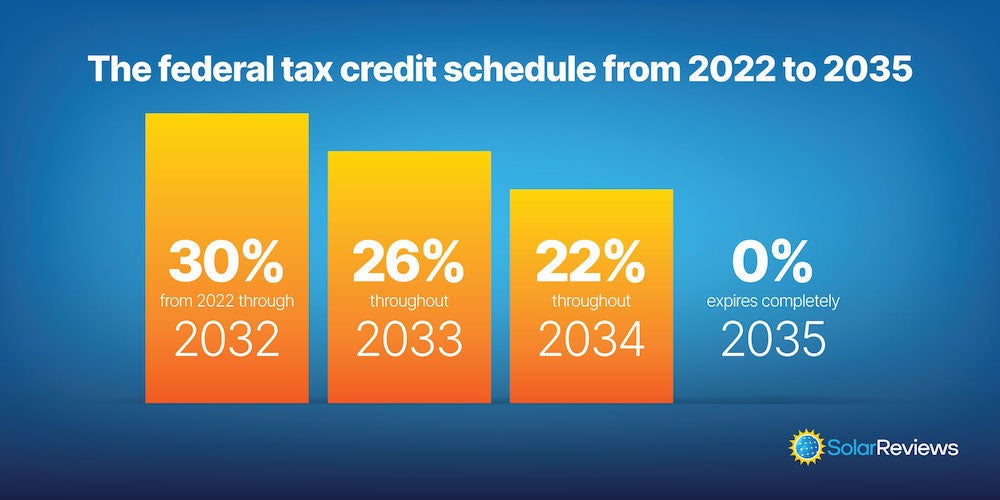

Do to the Inflation Reduction Act, the 30% tax credit was and is now available until 2032. In 2033, the value drops to 26%. In 2034, it falls again to 22% before expiring in 2035.

Who qualifies for the federal solar tax credit?

| Does qualify | Doesn’t qualify |

|---|---|

| Installations on primary or secondary residences, including houseboats, mobile homes, and condominiums | Installations on rental properties |

| Systems purchased with cash or a loan | Systems financed using a solar lease or PPA |

|

U.S. Taxpayers |

Citizens without taxable income |

| Original installation of equipment | Reinstallation of used equipment |

Most Americans qualify for the federal solar tax credit, but some eligibility criteria must be met:

- You must own the solar panel system: To use the tax credit, you must purchase the solar panels with cash or a loan. You will not get the tax credit if your solar panels are installed through a solar lease or a power purchase agreement (PPA).

- You must have taxable income: The tax credit reduces your tax liability. If your tax liability is zero, you can’t take advantage of the incentive immediately. You may be able to roll the credit forward if your tax liability increases in the following years.

- The solar system must be installed at your primary or secondary residence: You must be the person residing on the property to get the Residential Clean Energy credit. Rental properties do not qualify.

- It must be claimed on the original installation of the equipment: If you remove the panels and put them on another property, you cannot reclaim the tax credit.

Is there an income limit for the Residential Clean Energy credit?

There is no income limit for the Residential Clean Energy credit. You can claim the credit if you have tax liability and the system is eligible!

What costs are eligible for the federal tax credit?

| Eligible costs | Ineligible costs |

|---|---|

| Equipment | Additional projects (i.e., roof replacements) |

| Contract labor | Extended warranty coverage costs |

|

Sales tax |

Financing costs |

Most of the costs associated with installing solar panels are covered by the federal tax credit, including:

- Equipment: The cost of the solar panels, wiring, racking, and inverters.

- Contract labor: The cost of labor associated with site preparation, installation, planning, permitting, and inspections.

- Sales tax: Any sales tax associated with the above costs is covered by the tax credit.

However, some costs are not eligible for the tax credit. The tax credit will not cover roof replacements and extended warranty coverage costs. Most notably, financing costs are not included when calculating your tax credit value.

“You can still claim the full cost of the solar panels if you finance instead of purchasing outright. However, financing costs and interest would not be eligible to include, only the cost of the solar panels and installation,” says Kleczynski.

More than just solar panel installations qualify for the 30% Residential Clean Energy Credit. Eligible installations include solar panels, solar shingles, solar water heaters, residential wind turbines, geothermal heat pumps, fuel cells, and battery storage!

How to apply for the federal solar tax credit

Applying for the tax credit is easy! You need three things when filing for the tax credit:

- Tax Form 5695, which you can find on the IRS website

- The cost of your installation, which you can get from the contract or invoice from your installer

- How much you owe in taxes, that is listed on Form 1040, line 18

If you’re filing the tax credit yourself, you can download Form 5695 and instructions for filling it out from the IRS website. The instructions are relatively simple, so it won’t be difficult to claim the credit.

When using a tax software program, you’ll likely have to search for Form 5695 in the system, add it to your other tax documents, and input relevant information, like the cost of the system. The software will handle the calculations and what your final tax liability will be.

Filing with a tax preparer is also simple. You’ll need to provide them with the price of your system, and they’ll handle the rest for you.

Does the federal tax credit work with other local or utility solar incentives and rebates?

You can use the federal solar tax credit with any other available solar incentives. However, the incentive type can impact how the solar tax credit is calculated. Let’s take a closer look.

Utility rebates

In most cases, if you’re getting a rebate from your utility company, the value of the utility rebate will be subtracted from your total costs before the federal tax credit is calculated. This reduces the value of your federal tax credit, but you benefit from the additional incentive.

For example, let’s say you install a solar system for $20,000 and get a $1,000 rebate from your utility company. Instead of calculating the tax credit with the initial $20,000 cost, it would be based on the price after subtracting the utility rebate. In this case, that’s $19,000.

You can use the following formula to calculate how much your tax credit will be worth after a utility incentive:

30% x (Total system cost - Utility rebate amount) = Federal tax credit value

State solar tax credits

Some states offer solar tax credits that work similarly to the federal tax credit. The state tax credit will be worth a certain percentage of the solar installation costs and reduce taxpayers' state income tax liability.

A state tax credit won’t impact the value of your federal tax credit. However, claiming a state solar tax credit will change the amount of taxable income you report on your federal taxes.

The following table outlines where state-specific solar tax credits are available:

| State | Tax credit |

|---|---|

| Arizona | 25% of costs, up to $1,000 |

| Hawaii | 35% of costs, up to $5,000 |

| Deduction of 40% of costs in year 1 up to $5,000, 20% in years 2-4 | |

| Massachusetts | 15% of costs, up to $1,000 |

| New York | 25% of costs, up to $5,000 |

| South Carolina | 25% of costs, max of 50% of tax liability in any given year, roll over unused credit for up to 10 years |

Performance-based incentives

Performance-based incentives are paid to solar homeowners based on how much energy their solar system produces. These incentives likely will not change the value of your federal tax credit.

Sometimes, these incentives may be listed as a line item on your electricity bill; other times, you’ll receive a separate payment from your utility company.

Some states have Solar Renewable Energy Credits (SRECs), where a solar owner earns a certificate for every 1,000 kWh of solar energy they produce. These can then be sold to utilities or SREC aggregators and earn you extra money.

Sometimes, SRECs can be purchased upfront by the installer. If this is the case, you should consult a tax professional about how that could impact your solar tax credit value.

The best time to claim the solar tax credit is now!

You have about ten years to take advantage of the full 30% tax credit. But just because you can wait ten years doesn’t mean you should. It’s almost always a good idea to invest in solar sooner rather than later. Installing solar as soon as possible lets you start saving money earlier, so you can stop paying high electricity bills and start putting your money towards the things that really matter to you.

Not to mention, going solar will never be a better investment than it is right now. Local solar incentives could expire well before the federal tax credit. Take net metering, the incentive that pays you the full price of electricity for the solar energy you send to the grid, for example. Utilities across the country are moving away from net metering and paying solar customers less money for solar electricity.

You’ll want to install solar before things like net metering and utility rebates start to disappear to guarantee that you get the best solar savings possible.

Federal solar tax credit FAQ

How much is the federal solar tax credit worth?

The 2024 federal tax credit for solar installations is equal to 30% of solar installation costs. The average tax credit value is about $6,000, but the actual tax credit you earn depends on how much your installation costs.

When do I claim the solar tax credit?

You claim the tax credit when you file the taxes for the year the solar system was installed. So, if you installed solar in 2022, you would apply for the tax credit when you’re filing your taxes for the year in 2023.

You need to claim the tax credit in the same year you installed the panels. You can file an amended return to get the tax credit if you didn't claim the tax credit in time.

Can I use the solar tax credit with a solar with a loan?

Yes, you can use the solar tax credit if you paid for solar with a loan!

Many solar loans require you to pay the full value of the tax credit on your loan before 18 months to keep your loan payments low. If you don’t, your loan payments will increase. So, make sure you have that money on hand to pay down your loan when 18 months rolls around.

What types of property qualify for the federal tax credit?

Solar panels installed on houseboats, mobile homes, and condominiums can claim the federal tax credit if the borrower and the system meet all other eligibility requirements.

Off-grid solar installations can also earn the solar tax credit!

Can I claim the tax credit for solar installations on a rental property?

No, you cannot claim the Residential Clean Energy Credit on rental properties unless you also live in the building. However, your rental property may be eligible for the commercial solar tax credit (IRC Section 48).

Can I claim the tax credit on a vacation home?

Yes, you can claim the tax credit for solar installations on secondary residences. But check with your tax provider to determine if your vacation home meets the requirements to qualify.

Does battery storage qualify for the federal tax credit?

Battery storage does qualify for the federal tax credit, whether the battery is connected to solar panels or not.

Previously, batteries were only eligible if they were connected to a qualified solar system. But after the IRA passed, standalone batteries can now also take advantage of the tax credit.

Do Batteries Qualify for the Solar Tax Credit?

Yes. On Aug. 16, 2022, the IRA adds Section 48(a)(3)(A)(ix) to create an ITC for standalone energy storage technology with a minimum capacity of 3 kWh. Energy storage technology includes batteries, but it also applies more broadly to any energy storage technology that receives, stores and delivers energy for conversion to electricity, or to most technology that thermally stores energy (excluding swimming pools, combined heat and power systems, and building structural components). Energy storage installations that are placed in service after Dec. 31, 2022, and begin construction prior to Jan. 1, 2025, are entitled to the existing ITC under Section 48(a). Energy storage installations that begin construction after Dec. 31, 2024, will be entitled to credits under the technology-neutral ITC under new Section 48E (discussed below).

And it specifically addresses the Residential Clean Energy Credit for “qualified battery storage technology expenditure”

How much can I get from the battery storage tax credit?

The signing of the Inflation Reduction Act put into immediate effect the 30% Residential Clean Energy Credit, which applies to the cost of the battery and labor including the installation fee.

Can I apply for this battery tax credit if I don't have solar power system?

Yes.

Beginning on January 1, 2023, standalone battery storage (batteries that aren't connected to solar panels) will also qualify for the 30% Residential Clean Energy Credit. So if you only purchase some batteries for energy backup, don't worry, you also can have opportunity for this apply if meet the requirements that we're going through below.

Do all battery storage qualify for the Federal Tax Credit?

To qualify for the 30% tax credit, battery storage must be:

-Installed in connection with a dwelling unit located in the United States and used as a residence by the taxpayer

-(Have) a capacity of not less than 3 kilowatt hours.

Note: there are no maximum size, price, brand, manufacture or tax credit qualifications. So no matter your battery are made by US or other country, you can enjoy a 30% tax credit on as large of a battery system as you’d like.

Key takeaways

- The Residential Clean Energy Credit is a dollar-for-dollar income tax credit equal to 30% of solar installation costs.

- An average $20,000 solar system is eligible for a solar tax credit of $6,000.

- The Inflation Reduction Act extended the federal solar tax credit until 2035.

- To qualify for the federal solar tax credit, you must own the solar panels, have taxable income, and it must be installed at your primary or secondary residence.

- Eligible equipment for the federal tax credit includes photovoltaic solar installations, battery storage, solar water heaters, geothermal pumps, fuel cells, and wind turbines.

Summary

A vast majority of batteries installed between 2022 and 2032 will qualify for the solar tax credit expanded by the Inflation Reduction Act. The only qualifications specified by the Inflation Reduction Act are that the battery must be installed in a taxpayer's residence in the US, and the capacity of the battery storage must exceed 3 kWh. The 30% tax credit can be used to reduce your tax liability and can be carried forward if it's not all used at once. Even though it's available for the next 10 years, but the tax credit rate will step down, the 30% Section 25D credit lasts until Dec. 31, 2032, and then drops to 26% in 2033, and 22% in 2034. The credit is unavailable in 2035 and thereafter.

Disclaimer:

You should always consult your tax professional to determine your eligibility for tax credits given your individual situation. Zendure does not guarantee any tax credit based on our products, and any information we provide is for educational purposes only and should not be considered legal advice. It does not constitute professional tax advice or financial guidance. It should not be used as the only source of information when making purchasing decisions, investment decisions, tax decisions, or execution. Consult a tax professional to evaluate your eligibility.